Can I Get A 2nd Va Home Loan

You cant take advantage of this if youre still making mortgage payments on the property. In order to qualify for a 2nd va home loan you and your home will need to meet the same requirements as for the first loan.

Can I Use A Va Home Loan For A Second Home Va Hlc

Can I Use A Va Home Loan For A Second Home Va Hlc

can i get a 2nd va home loan

can i get a 2nd va home loan is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i get a 2nd va home loan content depends on the source site. We hope you do not use it for commercial purposes.

Va loan second home use.

Can i get a 2nd va home loan. Va loan is a good option that a veteran has in order to invest in property at an age when his income is not good enough to take loan from other financial authoritybecause of the repayment risk not all the leading financial institutions are keen to provide loan to veterans. Refinancing pays off the original loan in full. On top of those requirements you need to prove to the va that your.

Take a look at just a few. Qualifying for a second home loan. In order to get full entitlement restored you do need to apply for it through the va.

For example lets say you buy a home with a va loan and then later refinance into a conventional mortgage. You can use a second va loan to get a second home but there are stipulations you must follow. However if you live in one primary residence with a va loan and then buy another primary residence meaning you move there permanently and buy the home in good faith you can technically have tw.

This is a life long benefit for those who have served our country. Paying off your first va loan doesnt automatically restore your entitlement. One of the most common questions from borrowers who have purchased a home with a va loan is if they are able to use their benefit again.

If you have sold your home its important you know the steps to restore your eligibility so you can buy a second home using a va loan. Its not uncommon for veterans to find out their eligibility hasnt been restored after paying off a va loan. Fortunately there is no limit on the number of times a veteran can use the loan program.

Numerous circumstances exist that allow the borrower the opportunity to qualify for an additional va loan following a foreclosure bankruptcy or short salein fact the va has not set a cap on the number of times the va loan entitlement may be used. As with the second va loan you have to have entitlement available and youll have to be financially eligible for another mortgage. When those two are fully in place veterans can borrow as much as a lender is willing to lend without the need for a down payment.

Getting a second va loan. Certificate of eligibility coe. Planning to buy second home from va loan.

Can i buy a second home with a va loan. Say that a veteran takes out a va home loan a few years ago and soon rates begin to fall. Va loans are only available for primary residences.

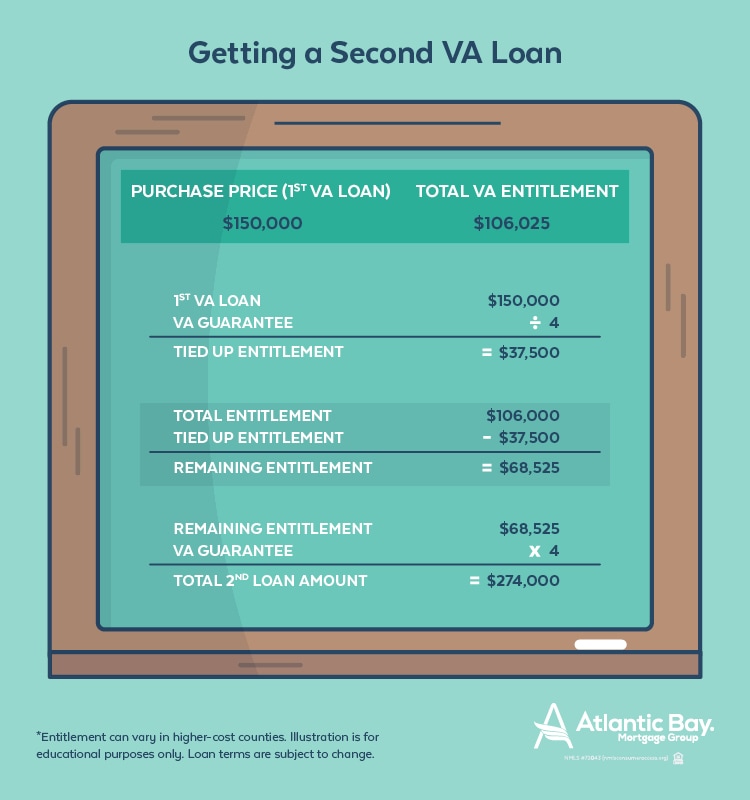

By lowering the interest rate on the mortgage the borrower can reduce their mortgage payment. The original va loan would need to be paid in full in order to pursue the one time restoration. There are two layers of va loan entitlement a basic level and a second tier of entitlement.

Yes You Can Get Another Va Home Loan

Yes You Can Get Another Va Home Loan

Va Loans Can They Be Used For Buying A Second Home Va Org

Va Loans Can They Be Used For Buying A Second Home Va Org

Va Loan Calculator Us Department Of Veterans Affairs Morgage

Va Loan Calculator Us Department Of Veterans Affairs Morgage

Two Va Loans At Once Can You Buy While You Still Own

Two Va Loans At Once Can You Buy While You Still Own

Multiple Va Loans At Once Are Allowed With Bonus Or 2nd Tier

Multiple Va Loans At Once Are Allowed With Bonus Or 2nd Tier

Va Loan The Real Estate Investor S Guide To Eligibility

Va Loan The Real Estate Investor S Guide To Eligibility

Va Loans What You Need To Know

Different Types Of Mortgage Loans

Different Types Of Mortgage Loans

Happy Investments Inc Los Gatos Ca 669 221 1550 By Losgatoshii

Happy Investments Inc Los Gatos Ca 669 221 1550 By Losgatoshii

Marine Veteran Loved To Fix Things But The Va Offered No Plan

Marine Veteran Loved To Fix Things But The Va Offered No Plan