Distinguish Between Debt And Equity Financing For Venture Creation

C302 describe processes used to acquire adequate financial resources for venture creationstart up. Debt investments such as bonds and mortgages specify fixed payments including interest to the investor.

Debt Financing Vs Equity Financing What S The Difference

distinguish between debt and equity financing for venture creation is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark distinguish between debt and equity financing for venture creation using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Equity is especially important for certain industries and kinds of businesses like technology startups and companies with global aspirations.

Distinguish between debt and equity financing for venture creation. What is equity financing. C204 assess risks associated with venture c205 describe external resources useful to entrepreneurs during concept development c206 use components of a business plan to define venture idea 3. Private equity is sometimes confused with venture capital because they both refer to firms that invest in companies and exit through selling their investments in equity financing such as initial public offerings ipos.

C303 describe considerations in selecting capital resources. C301 distinguish between debt and equity financing for venture creation. However there are major differences in the way firms involved in the two types.

A17 distinguish between debt and equity financing for venture creation a18 describe processes used to acquire adequate financial resources for venture creationstart up a19 select sources to finance venture creationstart up a20 explain factors to consider in determining a ventures human resource needs. Equity financing is where you trade ownership of your business to angel investors or venture capitalists in return for their capital. While both debt and equity investments can deliver good returns they have differences with which you should be aware.

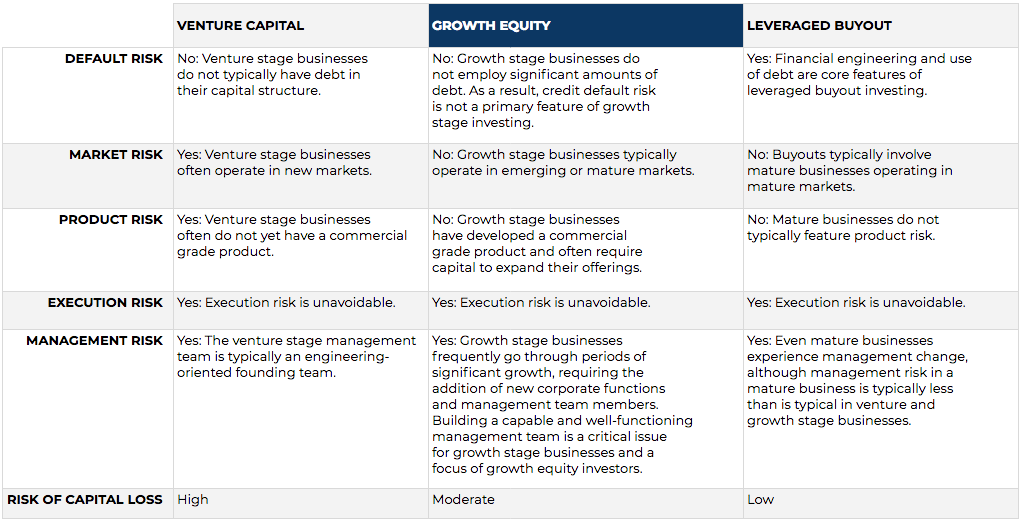

Discuss the resourcing stage of entrepreneurship. Equity investments such as stock are securities that come with a claim on the. By understanding the difference between growth equity and venture capital entrepreneurs can better target their fundraising efforts and focus on capital sources best suited to their business.

C304 assess the costsbenefits associated with resources. Discuss the resourcing stage of entrepreneurship c301 distinguish between debt and equity financing for venture creation.

Debt Vs Equity Top 9 Must Know Differences Infographics

Debt Vs Equity Top 9 Must Know Differences Infographics

Venture Debt A Capital Idea For Startups Kauffman Fellows

Thursday Morning Finance Ppt Video Online Download

Thursday Morning Finance Ppt Video Online Download

Understanding The Difference Between Growth Equity And

Understanding The Difference Between Growth Equity And

Debt Vs Equity Financing Advantages Disadvantages Example

Debt Vs Equity Financing Advantages Disadvantages Example

Understanding The Difference Between Growth Equity And

Understanding The Difference Between Growth Equity And

Venture Debt A Capital Idea For Startups Kauffman Fellows

Difference Between Debt And Equity Comparison Chart Key

Difference Between Debt And Equity Comparison Chart Key