Does Applying For Financing Hurt Your Credit

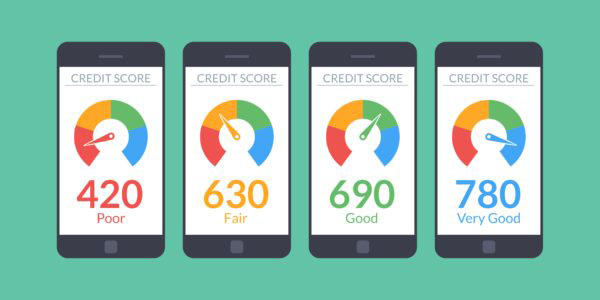

Timely loan payments will give you a good credit scoreand make you a more attractive borrowerwhile late loan payments will damage your credit score. While the number of inquiries is a factor in your credit score it generally has a relatively small impact with elements such as past payment history and use of credit receiving much more weight in the score.

Does Applying For A Loan Hurt My Credit Score Nerdwallet

Does Applying For A Loan Hurt My Credit Score Nerdwallet

does applying for financing hurt your credit is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark does applying for financing hurt your credit using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

By the experian team.

Does applying for financing hurt your credit. Doing so will also give an idea of areas that might need work to improve the credit standing before applying for the car loan. Does applying for a credit card hurt your credit. Because payment history is 35 of your credit score making payments on time is essential to building a good credit score.

Applying for an auto loan counts as an inquiry on your credit report. Getting a new car loan has two predictable effects on your credit. By farnoosh torabi.

I understand that multiple inquiries within a shopping timeframe do not hurt an individuals credit. Refinancing a car has a similar effect on your credit. How big is the impact and how long does it last.

Itll stay on your credit report for two years but only affect your scores for the first 12 months. What about applying for other types of loans. Impact on credit scores of inquiries for an auto loan.

How it can damage your credit. It adds to your credit history which has a positive impact assuming you pay on time every time. Even a single missed payment can hurt your credit score.

It adds a hard inquiry to your credit report which might temporarily shave a few points off your score. However the impact to your credit score should be the same as if youd applied for just one loan. A credit inquiry by a retailer can hurt your credit score especially if you are requesting new credit several times in a short period of time.

Youre applying for new credit. You may have heard that applying for credit can affect your credit score but you might not know exactly what the effects will be. The credit inquiry alone wont necessarily lower your credit score but if youre constantly refinancing andor applying for other types of new credit the inquiries could add up to a point where theyre deemed unhealthy.

July 12 2016 2 min read. While multiple loan applications can be treated as a single inquiry in your credit score even that single inquiry can cause your credit score to drop.

What Is A Hard Inquiry Credit Com

What Is A Hard Inquiry Credit Com

Does Applying For Multiple Student Loans Hurt My Credit

Does Applying For Multiple Student Loans Hurt My Credit

/GettyImages-170652637-57550d265f9b5892e8397aef.jpg) Will Multiple Loan Applications Hurt My Credit Score

Will Multiple Loan Applications Hurt My Credit Score

Does Cancelling A Loan Application Impact Your Credit Score

Does Cancelling A Loan Application Impact Your Credit Score

/loan-application-denied-4032776_final-45b6fa6db2bd4b25add8ecb2eb943202.png) What To Do If Your Loan Application Is Rejected

What To Do If Your Loan Application Is Rejected

How Student Loans And Paying Them Off Affect Your Credit Score

How Student Loans And Paying Them Off Affect Your Credit Score

![]() Refinancing A Loan Does It Hurt Your Credit Score Loans

Refinancing A Loan Does It Hurt Your Credit Score Loans

Does Checking Your Credit Hurt Your Credit Score

Does Checking Your Credit Hurt Your Credit Score

Can Personal Loans Hurt Your Credit Sofi

Can Personal Loans Hurt Your Credit Sofi

/images/2019/07/03/man-filling-loan-application-to-pull-credit.jpg) What Is A Hard Credit Pull And Does It Hurt Your Score

What Is A Hard Credit Pull And Does It Hurt Your Score